Python Finance Calculations

In this post, I will explain the methods of measuring risk in finance. One of the widely used concepts to measue the risk of an asset is the Sharpe Ratio. I have implemented a code in Python to compute the Sharpe Ratio for some assets.

from pandas_datareader import data # You will need to run "pip install pandas_datareader"

import holidays # You will need to run "pip install holidays"

import datetime

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from pandas.plotting import register_matplotlib_converters

register_matplotlib_converters()

pd.set_option('display.max_columns', None)

pd.set_option('display.max_rows', None)Useful resources:

https://readthedocs.org/projects/pandas-datareader/downloads/pdf/latest/

https://www.investopedia.com/terms/c/consumerpriceindex.asp

https://www.investopedia.com/insights/understanding-consumer-confidence-index/

https://fred.stlouisfed.org/series

ONE_DAY = datetime.timedelta(days=1)

HOLIDAYS_US = holidays.US()

def previous_business_day(specific_date):

previous_day = specific_date

while previous_day.weekday() in holidays.WEEKEND or previous_day in HOLIDAYS_US:

previous_day -= ONE_DAY

return previous_day

def next_business_day(specific_date):

next_day = specific_date

while next_day.weekday() in holidays.WEEKEND or next_day in HOLIDAYS_US:

next_day += ONE_DAY

return next_daydef get_historical_data(share, start_date='2019-01-01', end_date='2020-01-01', source='yahoo'):

try:

panel_data = data.DataReader(share, source, start_date, end_date)

except:

panel_data = pd.DataFrame()

return panel_datadef compute_average_annual_return(share, start_date='2019-01-02', end_date='2019-12-31', source='yahoo'):

panel_data = get_historical_data(share, start_date, end_date, source)

if panel_data.empty:

return None, None, None, None, None

adj_close = panel_data['Adj Close']

start_date = datetime.datetime.strptime(start_date, '%Y-%m-%d')

end_date = datetime.datetime.strptime(end_date, '%Y-%m-%d')

while start_date.strftime('%Y-%m-%d') not in adj_close.index:

start_date = next_business_day(start_date)

while end_date.strftime('%Y-%m-%d') not in adj_close.index:

end_date = previous_business_day(end_date)

delta = end_date - start_date

years = delta.days / 365

start_price = adj_close.loc[start_date.strftime('%Y-%m-%d')]

end_price = adj_close.loc[end_date.strftime('%Y-%m-%d')]

return_value = (end_price/start_price)**(1/years) - 1

return round(return_value, 4), start_date, end_date, delta, yearsdef compute_daily_return_std_per_year(share, start_date='2019-01-02', end_date='2020-01-02', source='yahoo'):

panel_data = get_historical_data(share, start_date, end_date, source)

if panel_data.empty:

return None

last_day_price = None

daily_returns = []

for index, row in panel_data.iterrows():

if last_day_price:

daily_returns.append(row['Adj Close']/last_day_price - 1)

last_day_price = row['Adj Close']

return round(np.std(daily_returns)*np.sqrt(252), 4)def compute_sharpe(share, start_date='2019-01-02', end_date='2020-01-02', source='yahoo'):

avg, _, _, _, _ = compute_average_annual_return(share, start_date, end_date, source)

std = compute_daily_return_std_per_year(share, start_date, end_date, source)

if not avg or not std:

return

return round(avg/std, 4)SP_500 = pd.read_excel('SP_500.xlsx', index_col=0)

SP_500_symbol_list = SP_500.index.to_list()[:-2]

iTickers = {}

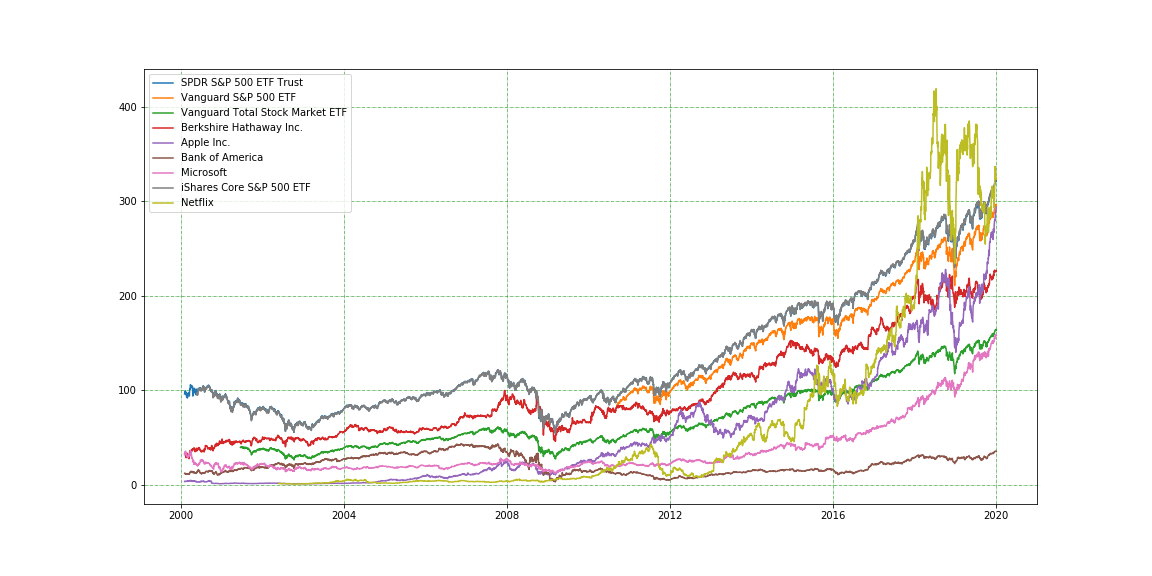

iTickers["SPY"] = "SPDR S&P 500 ETF Trust"

iTickers["VOO"] = "Vanguard S&P 500 ETF"

iTickers["VTI"] = "Vanguard Total Stock Market ETF"

iTickers["BRK-B"] = "Berkshire Hathaway Inc."

iTickers["AAPL"] = "Apple Inc."

iTickers["BAC"] = "Bank of America"

iTickers["MSFT"] = "Microsoft"

iTickers["IVV"] = "iShares Core S&P 500 ETF"

iTickers["NFLX"] = "Netflix"for symb in SP_500_symbol_list:

print("---------------\n", symb)

sharpe_ratio = compute_sharpe(symb)

print(SP_500.loc[symb]['Name'], sharpe_ratio)plt.figure(figsize=(16,8))

start_date='2000-01-31'

for symb in iTickers:

print(iTickers[symb])

daa = get_historical_data(symb, start_date=start_date)

sharpe_ratio = compute_sharpe(symb)

#print(SP_500.loc[symb]['Name'], sharpe_ratio)

print(iTickers[symb], sharpe_ratio)

plt.plot(daa['Adj Close'])

plt.grid(color='g', linestyle='-.', linewidth=0.5)

plt.legend([iTickers[sym] for sym in iTickers])

plt.savefig('well-known-tickers.png')SPDR S&P 500 ETF Trust

SPDR S&P 500 ETF Trust 2.5004

Vanguard S&P 500 ETF

Vanguard S&P 500 ETF 2.5269

Vanguard Total Stock Market ETF

Vanguard Total Stock Market ETF 2.4393

Berkshire Hathaway Inc.

Berkshire Hathaway Inc. 0.7833

Apple Inc.

Apple Inc. 3.42

Bank of America

Bank of America 1.9287

Microsoft

Microsoft 2.9596

iShares Core S&P 500 ETF

iShares Core S&P 500 ETF 2.5012

Netflix

Netflix 0.6069

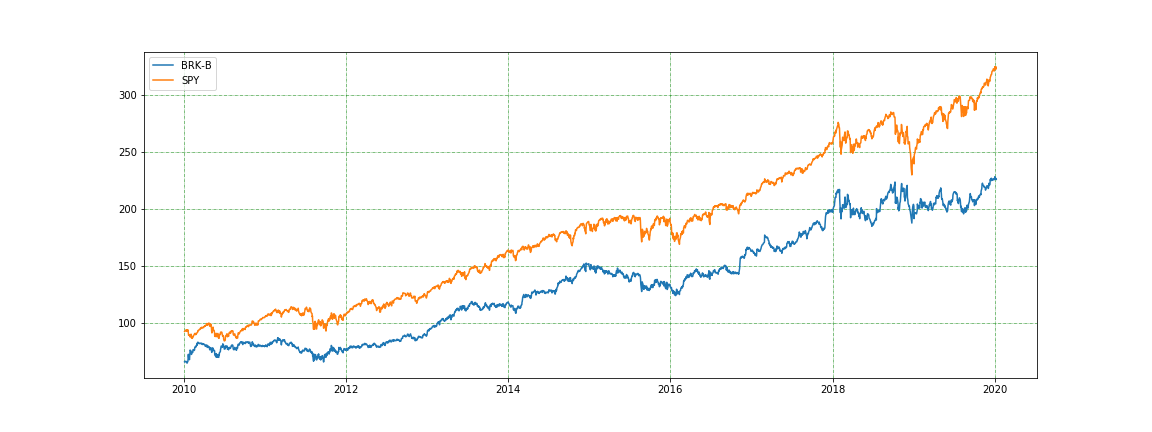

plt.figure(figsize=(16,6))

start_date='2010-01-02'

end_date='2020-01-07'

for symb in ['BRK-B','SPY']:

daa = get_historical_data(symb, start_date=start_date, end_date=end_date)

plt.plot(daa['Adj Close'])

plt.grid(color='g', linestyle='-.', linewidth=0.5)

plt.legend(['BRK-B','SPY'])

plt.savefig('BRK_vs_SPY.png')

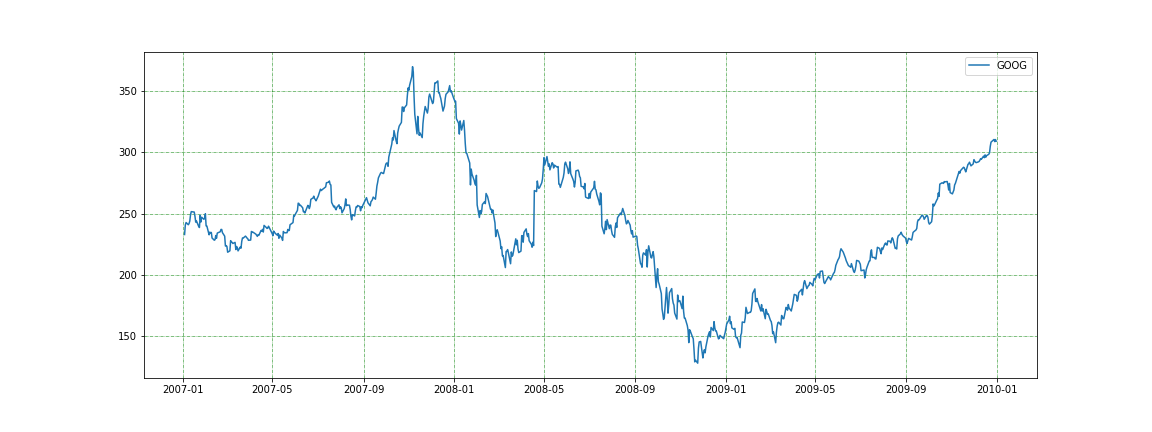

def plot_stock_price(stock, start_date='2019-01-02', end_date='2019-12-31', source='yahoo'):

plt.figure(figsize=(16,6))

daa = get_historical_data(stock, start_date=start_date, end_date=end_date, source=source)

sharpe_ratio = compute_sharpe(stock)

plt.plot(daa['Adj Close'])

plt.grid(color='g', linestyle='-.', linewidth=0.5)

plt.legend([stock])

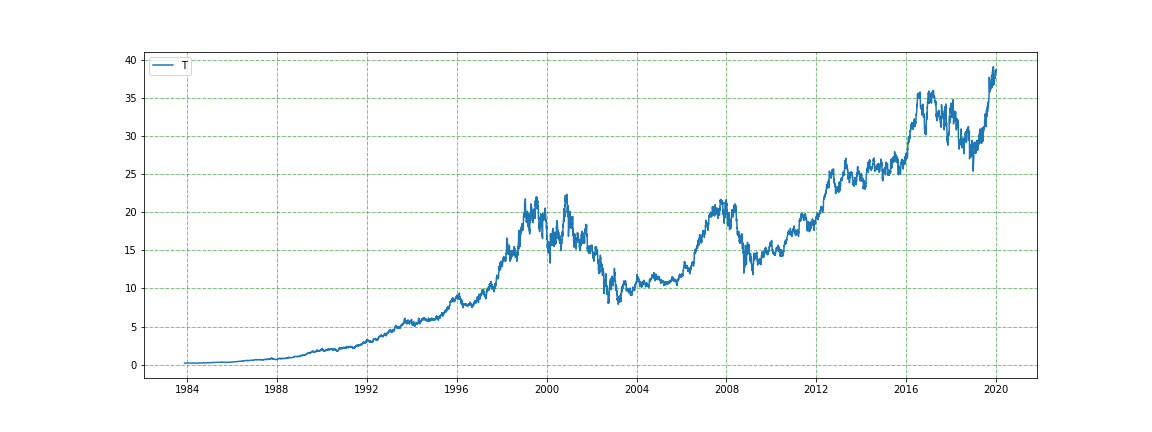

plt.savefig('{}_{}_{}.png'.format(stock, start_date, end_date))plot_stock_price('GOOG', start_date='2007-01-02', end_date='2010-01-02') AT&T

AT&T

plot_stock_price('T', start_date='1980-01-01', end_date='2020-01-01')

plot_stock_price('VTIP', start_date='1990-01-01', end_date='2020-01-01') Vanguard 500 Index Fund Admiral Shares

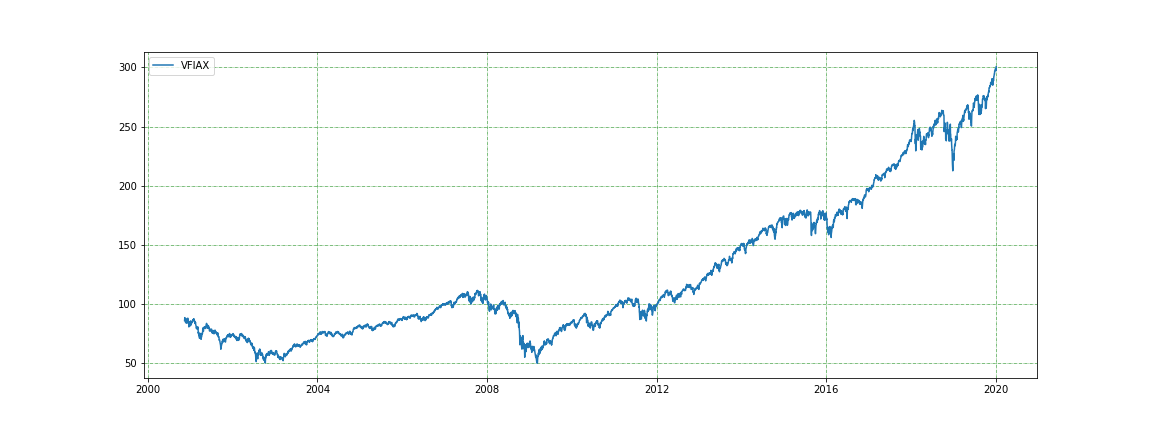

Vanguard 500 Index Fund Admiral Shares

plot_stock_price('VFIAX', start_date='1990-01-01', end_date='2020-01-01') iShares 20+ Year Treasury Bond ETF (TLT)

iShares 20+ Year Treasury Bond ETF (TLT)

plot_stock_price('TLT', start_date='1900-01-01', end_date='2020-01-01') 13 Week treasury bill

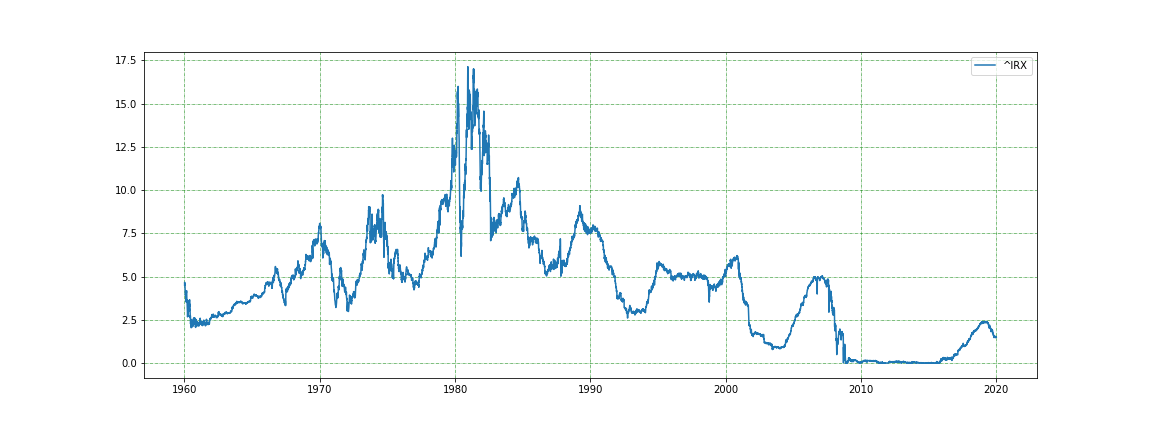

13 Week treasury bill

plot_stock_price('^IRX', start_date='1900-01-01', end_date='2020-01-01') 30 Year Treasury bill

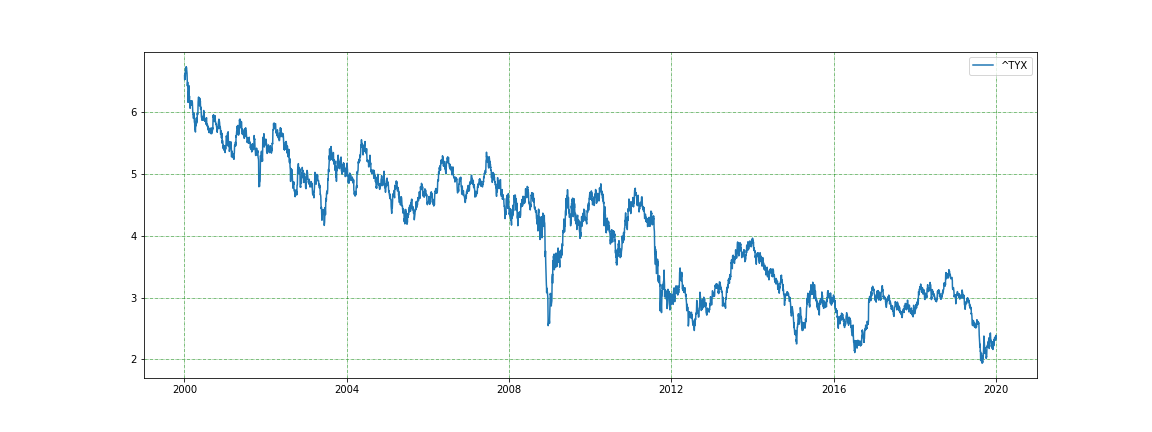

30 Year Treasury bill

plot_stock_price('^TYX', start_date='2000-01-01', end_date='2020-01-01') Vanguard Target Retirement 2045 Fund Investor Shares

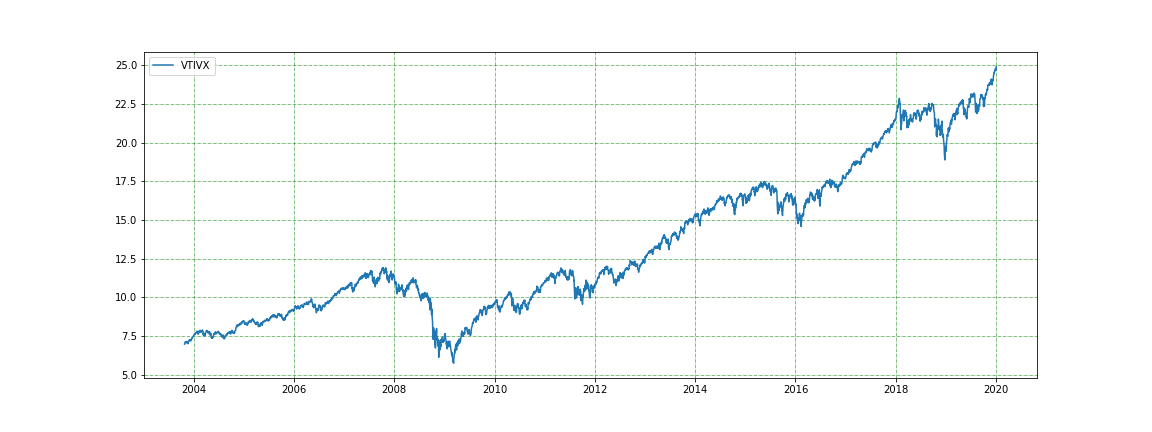

Vanguard Target Retirement 2045 Fund Investor Shares

plot_stock_price('VTIVX', start_date='2000-01-01', end_date='2020-01-01')

def compute_avg_annual_return_between_2_periods(shares, start_date='2000-01-02', end_date='2019-12-31', source='yahoo'):

shares_data = get_historical_data(shares, start_date=start_date, end_date=end_date, source=source)

adj_close = shares_data['Adj Close']

start_date = datetime.datetime.strptime(start_date, '%Y-%m-%d')

end_date = datetime.datetime.strptime(end_date, '%Y-%m-%d')

while start_date.strftime('%Y-%m-%d') not in adj_close.index:

start_date = next_business_day(start_date)

while end_date.strftime('%Y-%m-%d') not in adj_close.index:

end_date = previous_business_day(end_date)

start_prices = adj_close.loc[start_date.strftime('%Y-%m-%d')]

end_prices = adj_close.loc[end_date.strftime('%Y-%m-%d')]

#print(end_prices, start_prices)

return (end_prices/start_prices)**(1/(end_date.year - start_date.year)) - 1SP500_rate_of_return_all = compute_avg_annual_return_between_2_periods(SP_500_symbol_list)

SP500_rate_of_return = {x:round(SP500_rate_of_return_all.loc[x],2) for x in SP500_rate_of_return_all.index \

if not pd.isnull(SP500_rate_of_return_all.loc[x])}SP500_rate_of_return_clean = {k: v for k, v in sorted(SP500_rate_of_return.items(), key=lambda item: item[1])}compute_avg_annual_return_between_2_periods('BRK-B')0.10278063728967202

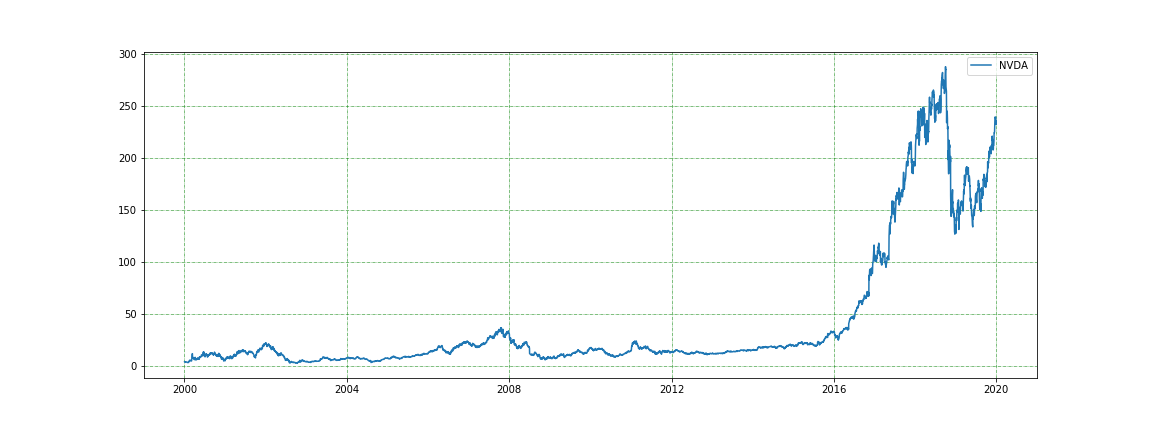

plot_stock_price('NVDA', start_date='2000-01-02', end_date='2019-12-31')

Overall economic indicators

def plot_us_gdp(start_date = '1900-01-01', end_date = '2020-01-01'):

plt.figure(figsize=(16,6))

gdp_data = get_historical_data('GDP', start_date = start_date, end_date = end_date, source = 'fred')

plt.plot(gdp_data)

plt.grid(color='g', linestyle='-.', linewidth=0.5)

plt.legend(['US GDP'])

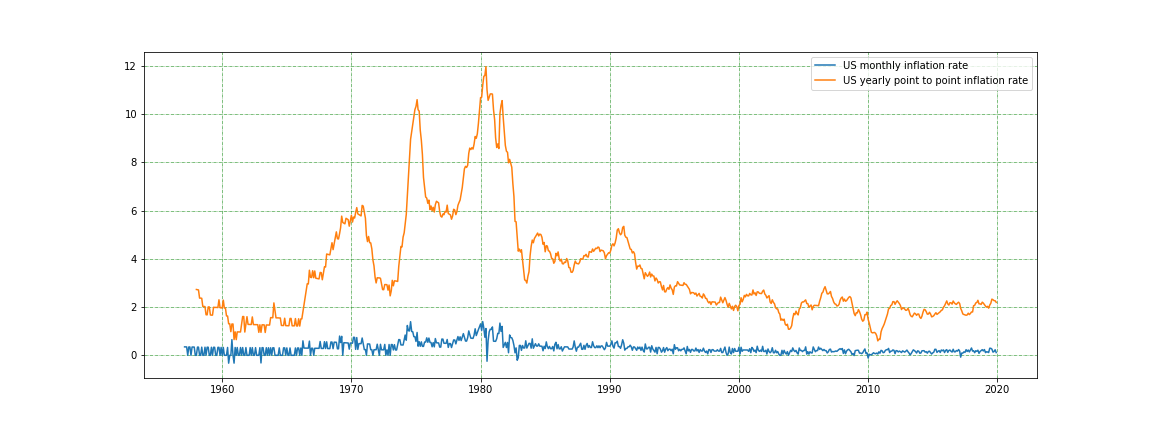

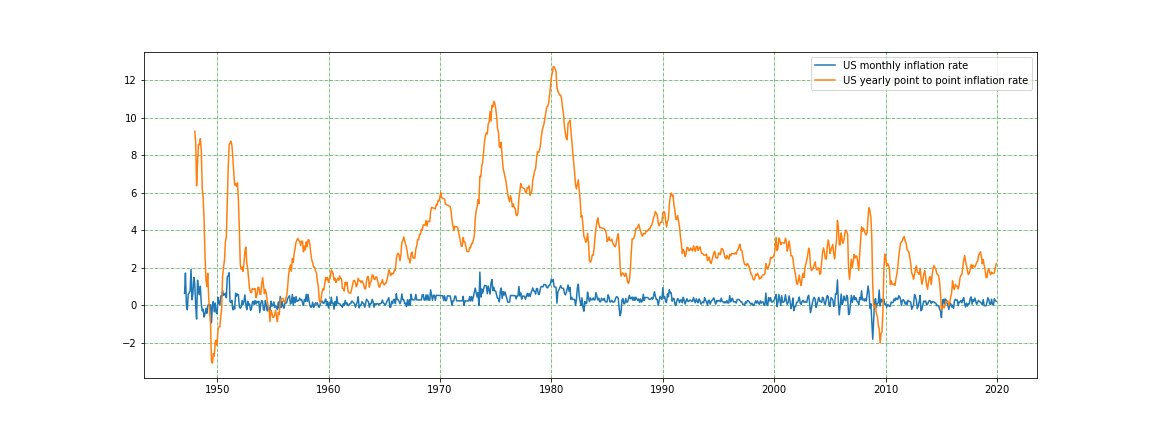

plt.savefig('us_gdp.png')def plot_us_inflation(start_date='1940-01-01', end_date='2020-01-01', index ='CPILFESL'):

CPI = get_historical_data(index, start_date = start_date, end_date = end_date, source = 'fred')

CPI['CPI_Diff_monthly'] = CPI[index].diff()

CPI['CPI_Diff_yearly'] = CPI[index].diff(12)

CPI['CPI_monthly_inflation_rate'] = (CPI['CPI_Diff_monthly']/CPI[index])*100

CPI['CPI_yearly_inflation_rate_pp'] = (CPI['CPI_Diff_yearly']/CPI[index])*100

plt.figure(figsize=(16,6))

plt.plot(CPI['CPI_monthly_inflation_rate'])

plt.plot(CPI['CPI_yearly_inflation_rate_pp'])

plt.grid(color='g', linestyle='-.', linewidth=0.5)

plt.legend(['US monthly inflation rate', 'US yearly point to point inflation rate'])

plt.savefig('us_inflation_data_{}.png'.format(index))

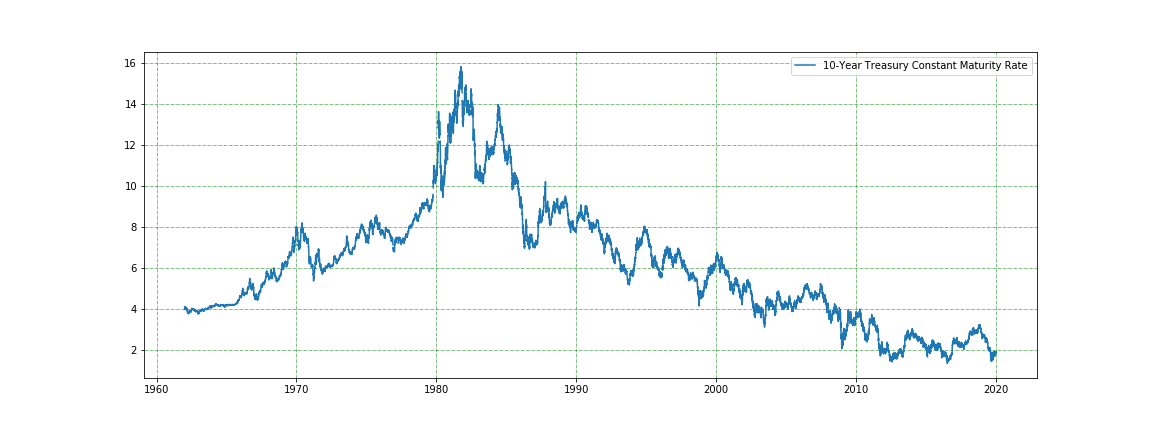

return CPIdef plot_index(index, start_date = '2010-01-02', end_date = '2020-01-02', source = 'fred'):

indx = get_historical_data(index, start_date, end_date, source)

plt.figure(figsize=(16,6))

plt.plot(indx)

plt.grid(color='g', linestyle='-.', linewidth=0.5)

index_meaning = {'DGS30': '30-Year Treasury Constant Maturity Rate',

'DGS20': '20-Year Treasury Constant Maturity Rate',

'DGS10': '10-Year Treasury Constant Maturity Rate',

'DGS7': '7-Year Treasury Constant Maturity Rate',

'DGS5': '5-Year Treasury Constant Maturity Rate',

'DGS3': '3-Year Treasury Constant Maturity Rate',

'DGS2': '2-Year Treasury Constant Maturity Rate',

'DGS1': '1-Year Treasury Constant Maturity Rate',

'DGS6MO': '6-Month Treasury Constant Maturity Rate',

'DGS3MO': '3-Month Treasury Constant Maturity Rate',

'DGS1MO': '1-Month Treasury Constant Maturity Rate',

'FEDFUNDS': 'US Effective Federal Funds Rate',

'LIBOR': '3-Month London Interbank Offered Rate',

'NIKKEI225': 'Nikkei Stock Average, Nikkei 225',

'UNRATE': 'US Civilian Unemployment Rate',

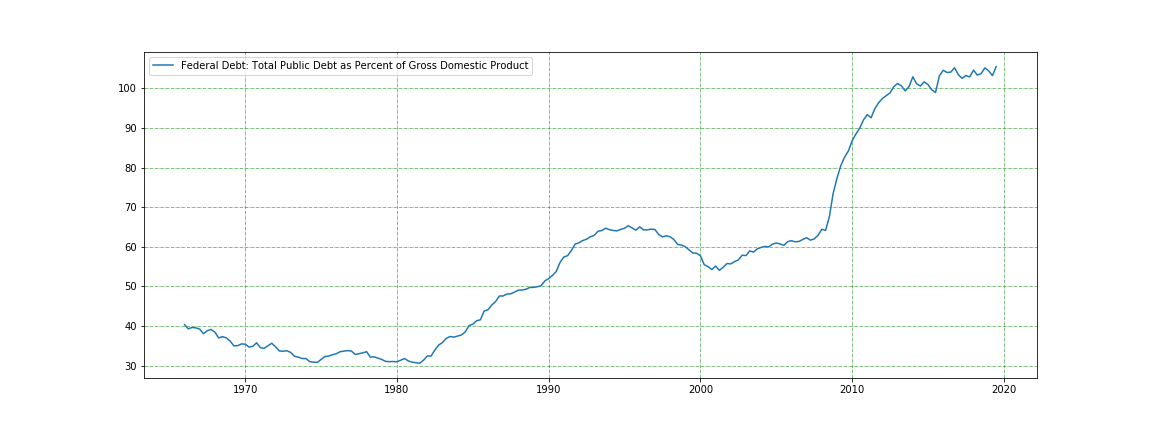

'GFDEGDQ188S': 'Federal Debt: Total Public Debt as Percent of Gross Domestic Product',

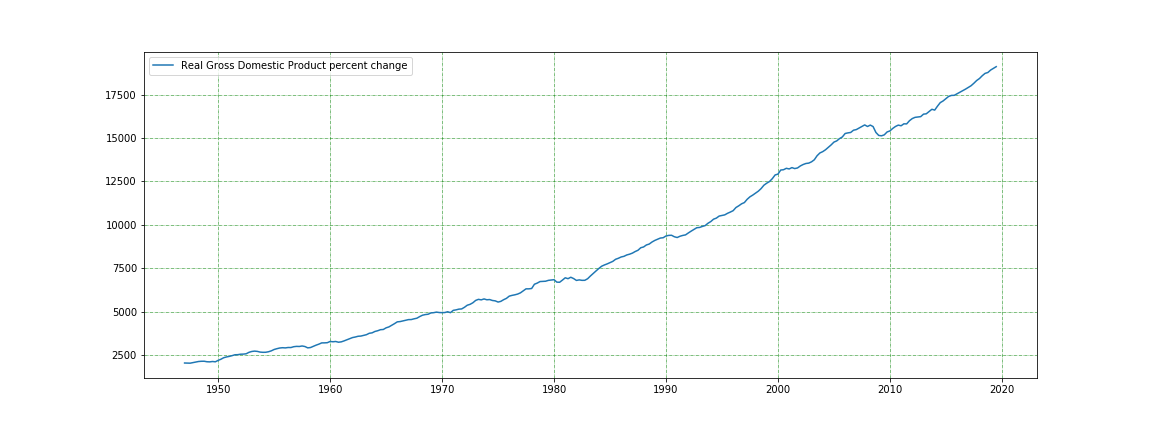

'GDPC1': 'Real Gross Domestic Product percent change',

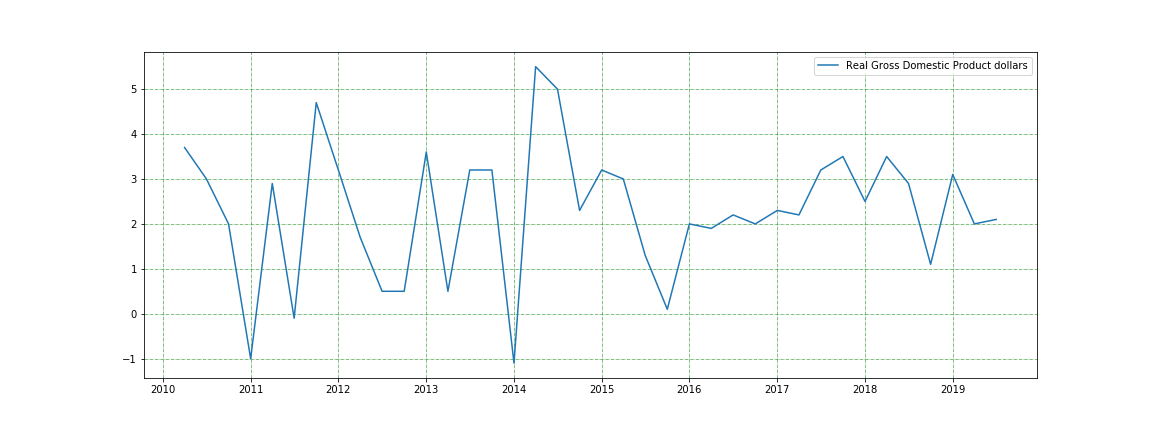

'A191RL1Q225SBEA': 'Real Gross Domestic Product dollars',

'CPIAUCSL': 'Consumer Price Index for All Urban Consumers: All Items',

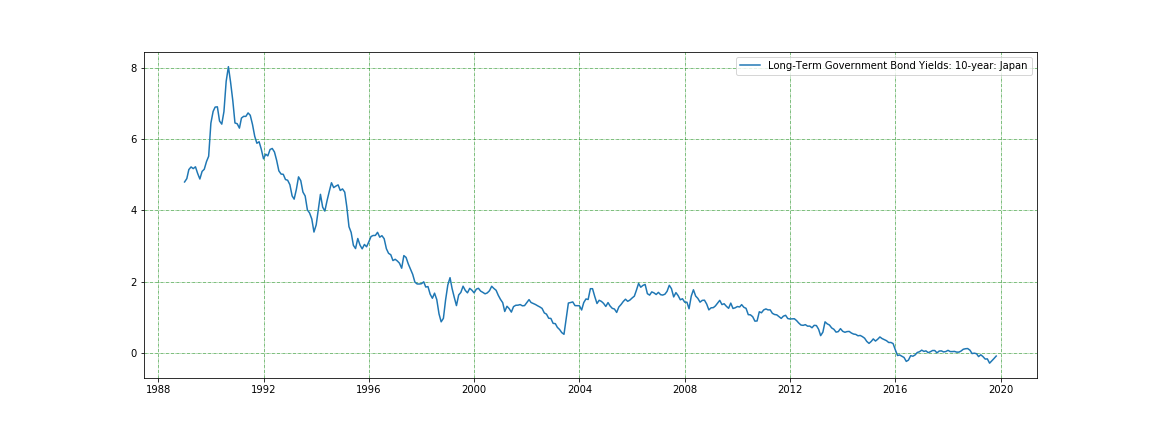

'IRLTLT01JPM156N': 'Long-Term Government Bond Yields: 10-year: Japan'

}

plt.legend([index_meaning[index]])

plt.savefig('index_{}_{}_{}.png'.format(index, start_date, end_date))Plotting the yield maturity curve

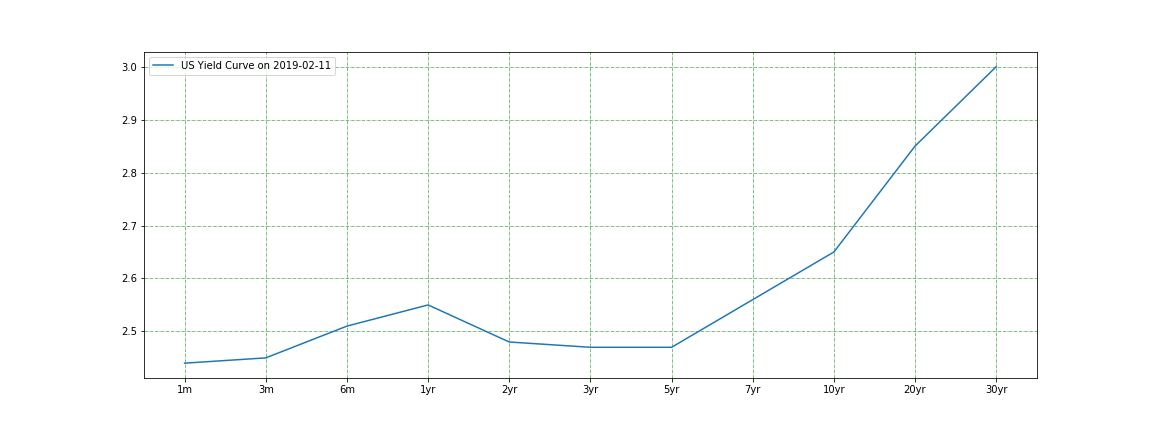

def plot_yield_curve(specific_date):

next_date = next_business_day(datetime.datetime.strptime(specific_date, '%Y-%m-%d'))

specific_date = next_date.strftime('%Y-%m-%d')

syms = ['DGS1MO', 'DGS3MO', 'DGS6MO', 'DGS1', 'DGS2', 'DGS3', 'DGS5', 'DGS7', 'DGS10', 'DGS20', 'DGS30']

yc = data.DataReader(syms, 'fred', specific_date, specific_date)

names = dict(zip(syms, ['1m', '3m', '6m', '1yr', '2yr', '3yr', '5yr', '7yr', '10yr', '20yr', '30yr']))

yc = yc.rename(columns=names)

plt.figure(figsize=(16,6))

#plt.plot([1, 3, 6, 12, 24, 36, 60, 84, 120, 240, 360], yc.loc[specific_date])

plt.plot(yc.loc[specific_date])

plt.grid(color='g', linestyle='-.', linewidth=0.5)

plt.legend(['US Yield Curve on {}'.format(specific_date)])

plt.savefig('yield_curve_{}.png'.format(specific_date))

return yc.loc[specific_date]yields = plot_yield_curve('2019-02-11')

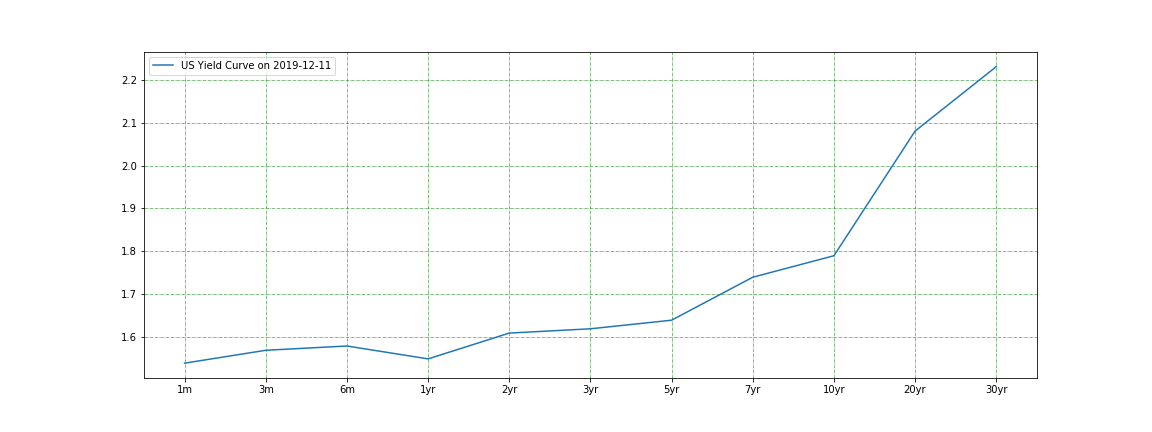

yields = plot_yield_curve('2019-12-11')

plot_index('DGS6MO')

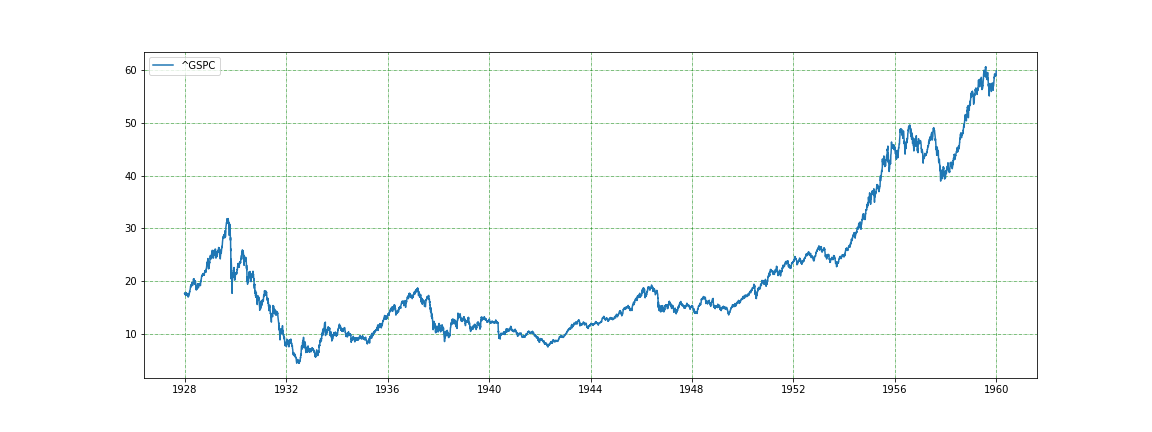

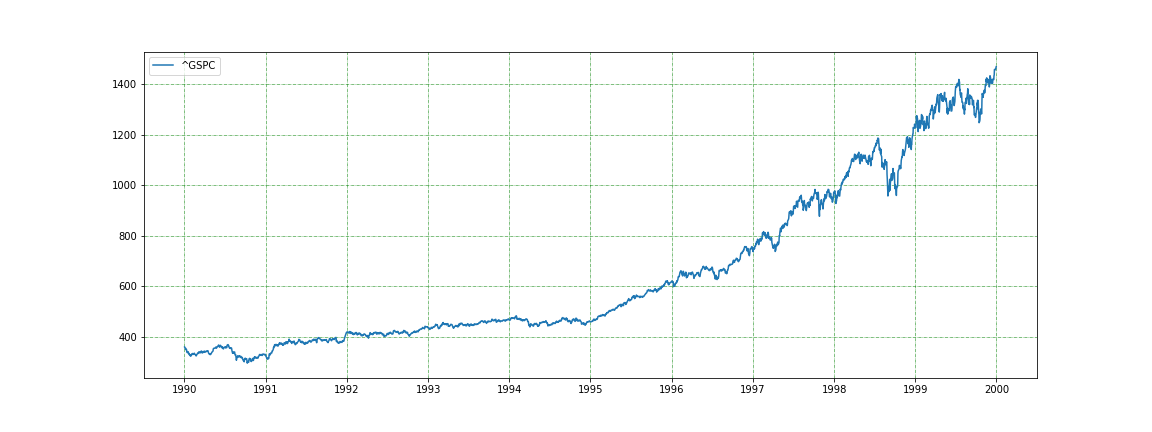

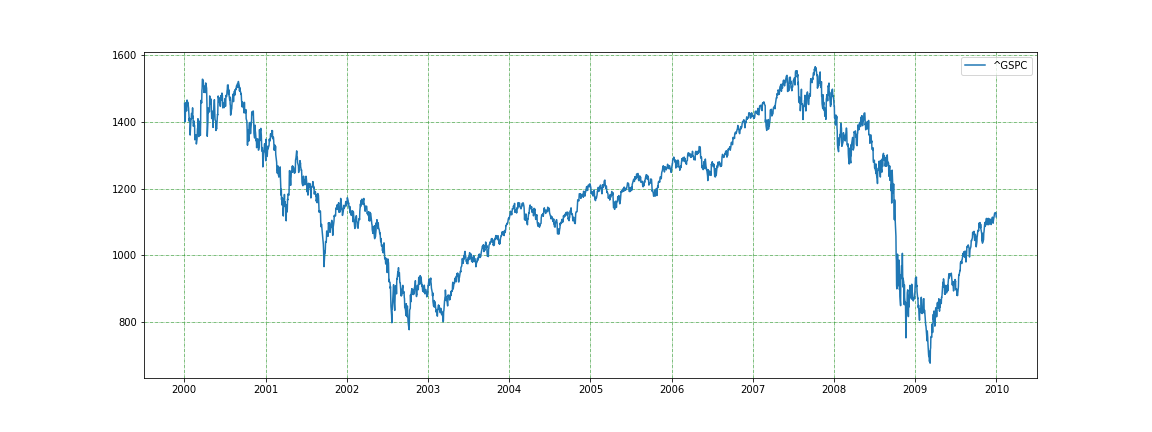

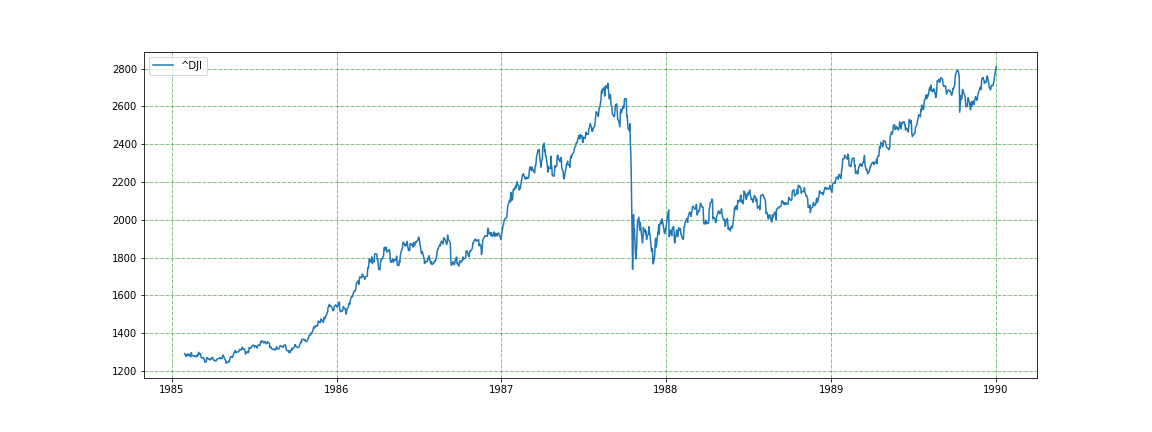

SP-500 index plots over different decades.

plot_stock_price('^GSPC', start_date='1900-01-01', end_date='1960-01-01')

plot_stock_price('^GSPC', start_date='1960-01-01', end_date='1970-01-01')

plot_stock_price('^GSPC', start_date='1970-01-01', end_date='1980-01-01')

plot_stock_price('^GSPC', start_date='1980-01-01', end_date='1990-01-01')

plot_stock_price('^GSPC', start_date='1990-01-01', end_date='2000-01-01')

plot_stock_price('^GSPC', start_date='2000-01-01', end_date='2010-01-01')

plot_stock_price('^GSPC', start_date='2010-01-01', end_date='2020-01-01')

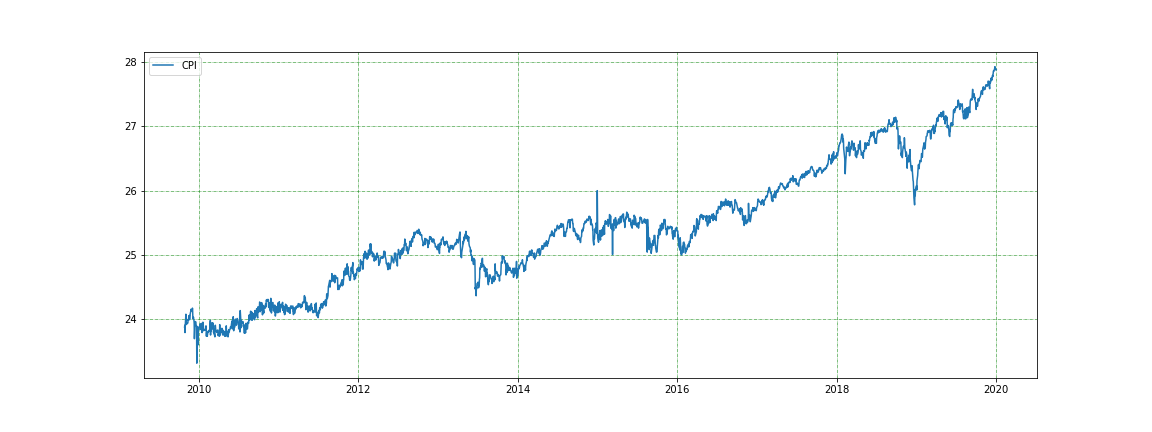

Consumer Price Index plot

plot_stock_price('CPI', start_date='1990-01-01', end_date='2020-01-01')

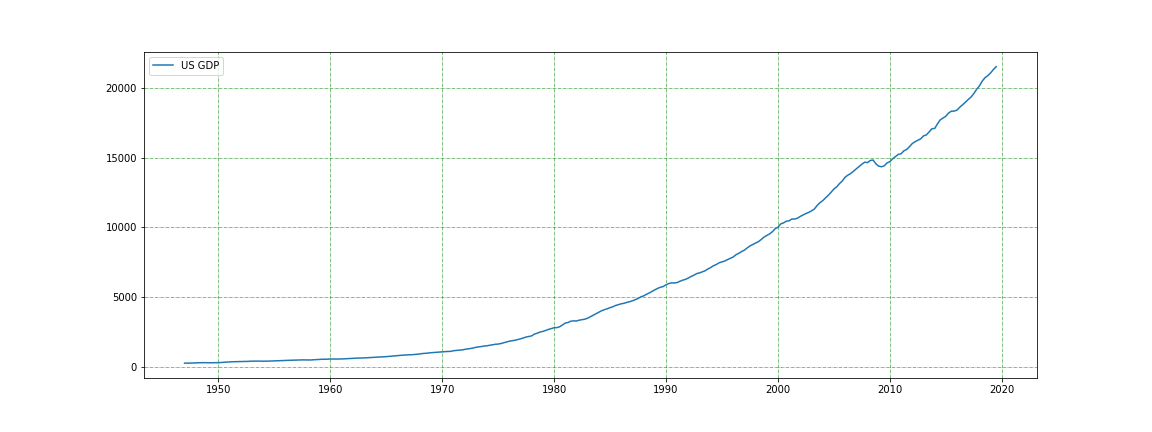

US GDP

gdp = plot_us_gdp()

US inflation plots

cpi_u_inflation_data = plot_us_inflation(index = 'CPILFESL')

cpi_u_inflation_data = plot_us_inflation(index = 'CPIAUCSL')

Consumer Confidence Index plot

plot_stock_price('CCI', start_date='1960-01-01', end_date='2020-01-01')

Dow Jones Industrial Average

plot_stock_price('^DJI', start_date='1940-01-01', end_date='1990-01-01')

plot_stock_price('^DJI', start_date='1990-01-01', end_date='2020-01-01')

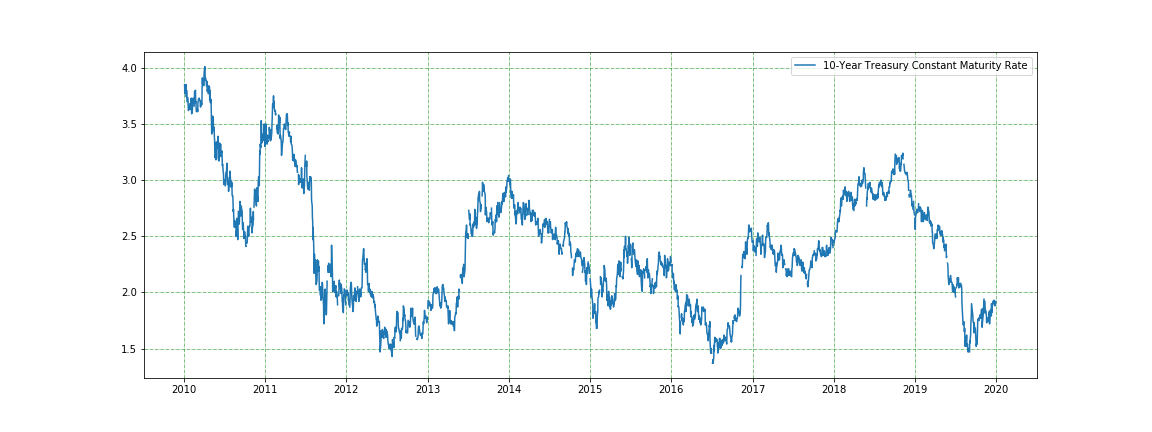

Plot of 10 year treasury bond interest rate

plot_index('DGS10', start_date = '1950-01-02')

plot_index('DGS10', start_date = '2010-01-02')

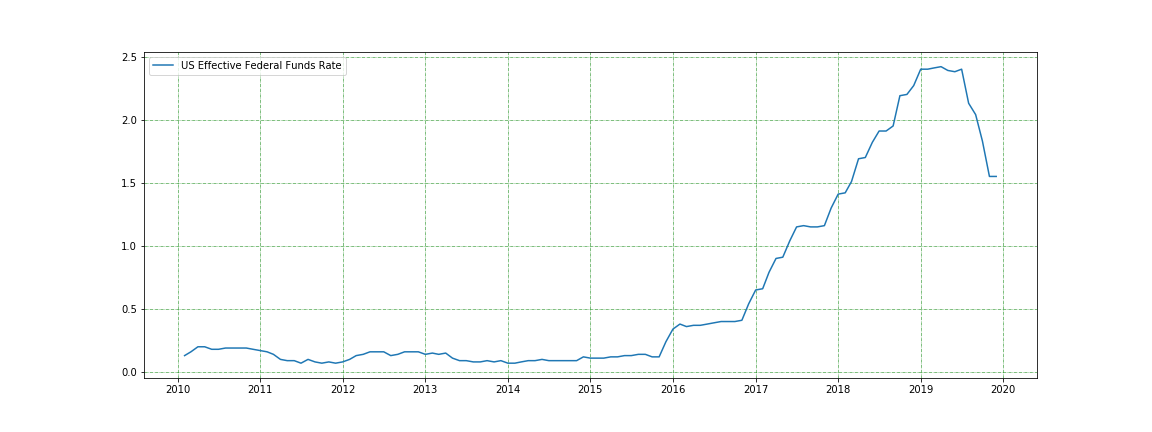

US Effective Federal Funds Rate

plot_index('FEDFUNDS')

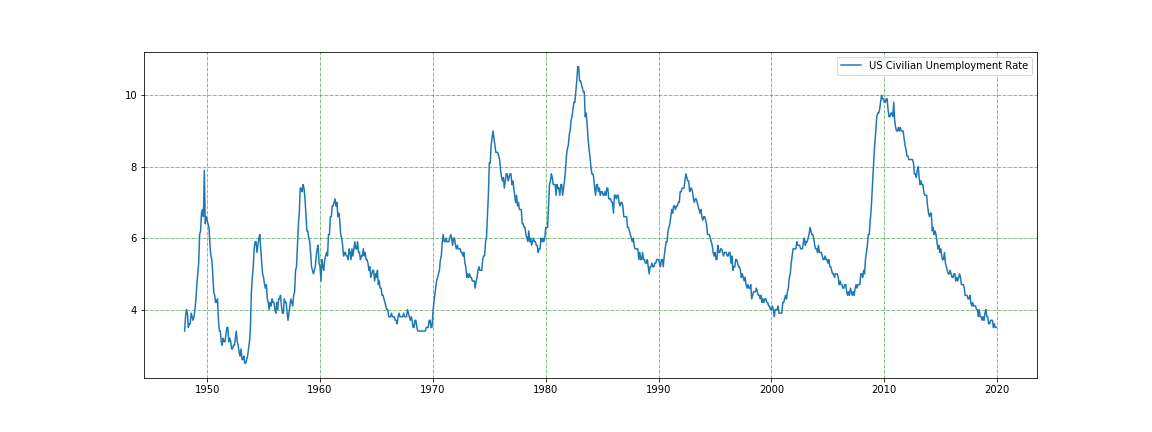

US unemployment rate

plot_index('UNRATE', start_date = '1910-01-02')

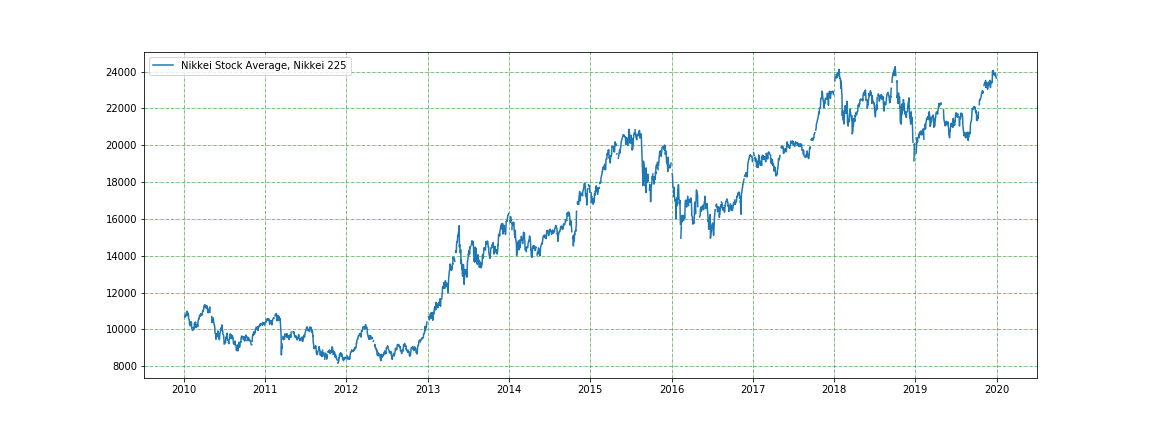

NIKKEI Index

plot_index('NIKKEI225')

US Debt/GDP percentage plot

plot_index('GFDEGDQ188S', start_date = '1910-01-02')

US GDP

plot_index('GDPC1', start_date = '1910-01-02')

plot_index('A191RL1Q225SBEA', start_date = '2010-01-02')

Japenese interest rate plot

plot_index('IRLTLT01JPM156N', start_date = '1940-01-02')

nasdaq = data.get_nasdaq_symbols()

print(nasdaq.shape)

nasdaq.head()def compute_stats(symb):

ticker = data.get_quote_yahoo(symb)

ticker['c1_marketCap_bn_calc'] = ticker['price'] * ticker['sharesOutstanding'] / 1e9

ticker['c2_marketCap_bn_orig'] = ticker['marketCap'] / 1e9

ticker['c3_price_calc'] = ticker['epsForward'] * ticker['trailingPE']

ticker['c4_earnings_bn_calc'] = ticker['epsForward'] * ticker['sharesOutstanding'] / 1e9

return tickercompute_stats(['EXPE', 'GOOG', 'MSFT', 'AAPL', 'BB', 'JNPR', 'BRK-B', 'BRK-A'])Getting historic stock dividends

get_historical_data('AAPL', start_date='2019-01-02', end_date='2019-12-31', source = 'yahoo-dividends')A summary of this code is available in this notebook.